Margin Of Safety Book Review

448 pages · 2014 · 10 mb · 4,227 downloads · new! It contains the usual warnings.

Write Effective Sales Letter (32 Pro Tips) Sales letter

Margin of safety is an excellent guide for investors because it focuses on how to succeed by not failing.

Margin of safety book review. The basic approach involves buying a stock or a bond at a discount to its intrinsic value, then holding onto it until that value is realized in the market. The book is comprised of three main parts: It is sometimes said to be the most important book available on value investing after the intelligent investor by benjamin graham.

Just like charlie munger's saying all i want to know is where i'm going to die so i'll never go there, seth klarman devotes the first part of the book to highlight how most investors stumble: A.}, abstractnote = {the nuclear safety management final rule, 10 cfr 830, provides an undefined term, margin of safety (mos). Sally hogshead is the author of this superb book.

My notes are informal and often contain quotes from the book as. Book review margin of safety by seth klarman investment quotes personal finance books book summaries. Those just starting off their investment journey and those well versed in how the stock market works found the author’s insights refreshing and valuable.

That is was why his book margin of safety was a natural choice for our first equity mates book review. Part 1 was about common mistakes of investors. Only 5,000 copies were printed in 1991 and none have been printed since.

Part 1 was about common mistakes of investors. Graham, “buying at a substantial discount from underlying value. Below are some of my favourite excerpts from margin of safety, and related seth klarman investing material.

Nevertheless the lessons to be learned from reading the book are timeless. The contents of the book “margin of safety” is written inclear and concise language.

Moreover, klarman has declined to get a more printed to provide a security value to the printed book! And by investing at a discount, he will be unlikely to experience losses.” a mos is achieved when securities are purchased at prices sufficiently below underlying value, to allow for human error, bad… Reviews for klarman’s margin of safety book are through the roof.

In part 3 klarman lays out the most important aspects of a value investment process. I can already tell you this: I love reading books on value investing written by the experts who have done it so well.

Basically, when klarman speaks we should all listen. Therefore, the author depicts to be a business expert from the marketing and sales of this very book! Margin of safety (1991) by seth a.

This book is worth your time! Graham really was a pioneer in behavioral finance before behavioral finance was even a thing, and the margin of safety concept was one of the first tools that allowed investors to overcome their own. What i found in margin of safety was a very good basic book on value investing.

The beauty of “margin of safety” lies in both the concept’s simplicity and in its effectiveness in protecting investors from making big mistakes. “margin of safety” is written inclear and concise language. The book discusses klarman's views about value investing, temperance, valuation, portfolio management, among other topics.

Margin of safety risk averse value investing strategies for the thoughtful investor by seth a klarman pdf in 2021 investing strategy investing books value investing. Margin of safety, seth a. The margin of safety by seth klarman covers a broad spectrum from providing sound education on the psychology of investing as well as developing the quantitative and qualitative aspects of value investing.

What commends this book to our attention? While margin of safety is sure to cost you thousands of dollars if you buy it online, there are tons of margin of safety pdf downloads and notes available free on the internet. Klarman definition shared by ben.

She became famous in the advertising profession during her early 20s. Heh, i was looking at the nyssa website and stumbled on a book review written in 2011 of joel greenblatt’s the big secret for the small investor and forgot that i wrote the review. However the careful reader will find precious nuggets of wisdom specially with regard to the internal workings of financial institutions and how they are not as efficient as they are made out to be.

It is useful to get their differential insights. Nearly everyone rated its contents five or four stars out of five. @article{osti_1134068, title = {margin of safety definition and examples used in safety basis documents and the usq process}, author = {beaulieu, r.

This book is widely regarded as a classic text on value investing. Klarman draws from the earlier investment book the intelligent investor, chapter 20, which is. A margin of safety is necessary because valuation is an imprecise art, the future is unpredictable, and investors are human and make mistakes.

I can strongly recommend the book. My two criticisms are that there are far too few examples of value investing in action and it is obviously dated. This is part 8 of our book review of the intelligent investor, revised edition, updated with new commentary by jason zweig (affiliate link).

Neither is sufficient on its own for us to be interested” mark curnin This is my book summary of margin of safety by seth klarman. My two criticisms are that there are far too few examples of value investing in action and it is obviously dated.

Nevertheless the lessons to be learned from reading the book are timeless. If you are interested in value investing or want to improve on the topic then this book is worth your time! Now, the book margin of safety has a reputation for selling at the rates of $1,000+ a copy on amazon.

The book itself is worth quickly touching on. “the function of margin of safety is, in essence, that of rendering unnecessary an accurate estimate of the future” ben graham “margin of safety for us comes from the quality of the business and second from buying into it at a substantial discount to our estimate of intrinsic value.

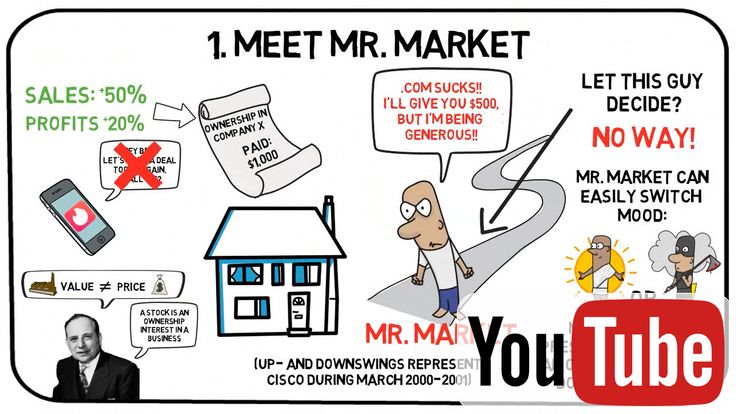

Meet Mr. Market The intelligent investor video, the

Book Review of Margin of Safety RiskAverse Value

Insist On A Margin Of Safety The intelligent investor

investing stockmarket financialsuccess coaching

Book Review Margin of Safety by Seth Klarman Book

Post a Comment for "Margin Of Safety Book Review"